The stock market has been on a terror. The Dow blowing through a 1000 point increase in just a few days from the end of 2017 into the new year. The S&P rose 19.4% excluding dividends, in 2017 and is up again in 2018.

Are we on a sugar high? Can this growth be sustained? Aren’t we do for a market correction?

Following several economists and market strategists, there is a consensus that growth will continue in the US and international economies for 2018. Fidelity ‘simplified’ a complicated topic.

Fidelity states there are 3 basic concepts for a bright economic outlook.

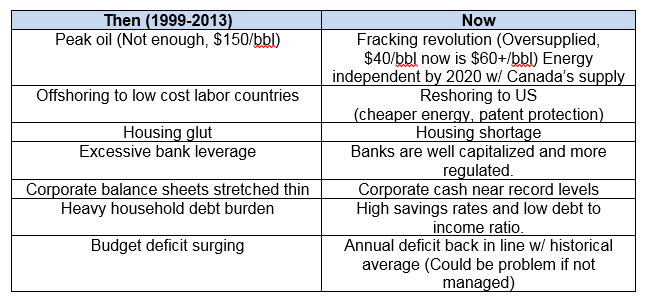

- We have resolved many of our structural issues.

- Economy is doing better than people think.

- Labor market remains strong. Unemployment rates are the lowest they have been in decades.

- No immediate inflation concerns CPI total and CPI core total hovering at 2% (per Factset)

- Company earnings have been growing again after S&P Dow Jones indices being flat for 2014, 2015 & 2016. (Stock prices follow earnings.)

- There is more stimulus coming out of Washington.

- Taxes- Tax Bill is estimated to cut 2018 tax obligations by about $200 Billion. Fidelity estimates that will increase GDP by 0.3%.

- Cut in corporate taxes will add about $10 in earnings to companies that are a part of the S&P 500 Index.

- Significant repatriation of cash sitting on foreign balance sheets is likely. ($2.3 Trillion available for S&P 500 Companies alone.)

- Deregulation (e.g. Energy, Financial, Healthcare)

- Fiscal Stimulus

-Infrastructure (next?)

-Increase in Defense spending

-Rebuilding of Houston, Florida & Puerto Rico

The future is not without risks

- Geopolitical (North Korea, Iran/Saudi Arabia)

- US Trade Policy- (NAFTA, China i.e. protectionism)

- Slowdown in China?

- Monetary policy mistake?

What is an investor to do?

Be diversified among asset classes i.e. stock, international, bonds. (Multiple funds invested in Large Cap is not diversified.)

Brian Westbury, Chief Economist for First Trust, states “The better strategy for most investors is don’t sell. Some sort of correction is inevitable but know one knows for sure when it will happen and few have discipline to take advantage of the situation.”